Lloyds Banking Group recently published an article on blockchain and tokenization, making complex concepts accessible to non-technical readers through clever analogies.

Here are three key takeaways about blockchain and tokenization:

- Pain points of current financial system

Today’s financial industry uses digital ledgers for customer records, enabling convenient payments. However, even simple transactions involve multiple systems, messaging layers and third parties. Cross-border transfers are even more complex.

This highlights the issues with the current system – non-streamlined, non-composable and siloed ledgers that are time-consuming and resource-intensive to maintain. The potential for improvement through incremental upgrades is limited.

The industry relies on global networks, intermediaries and their systems, which can lead to friction and delays due to time zone differences and jurisdictional constraints.

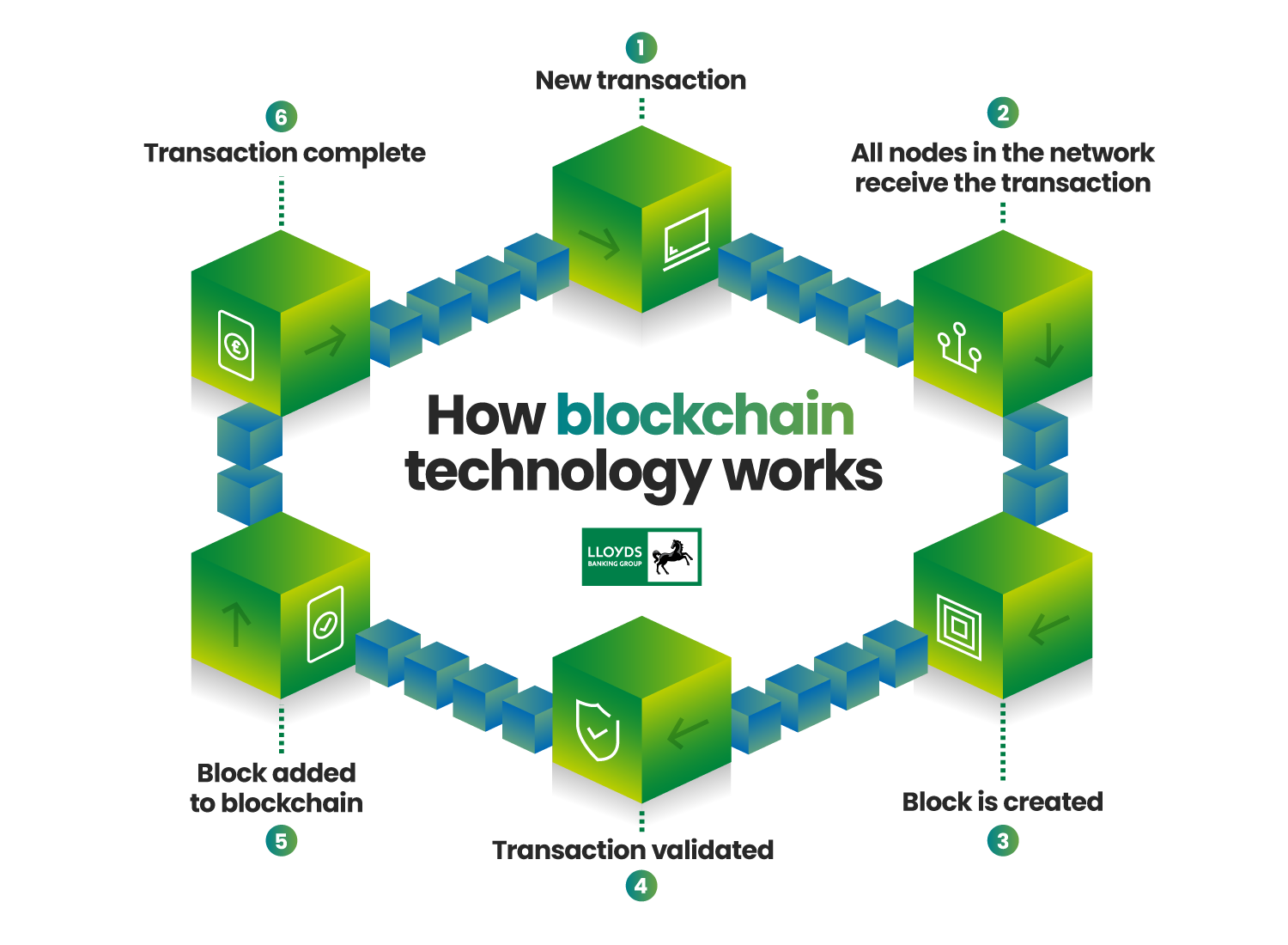

- Blockchain as a social messaging group

Blockchain offers an alternative, similar to a social messaging group where members interact in real time. Transactions are like messages, nodes are members, and chat history represents financial events. This approach ensures transparency while allowing for privacy through encryption. - Financial institutions remain key players

Financial institutions will continue to play crucial roles in a tokenized world, acting as transaction composers and recordkeepers in a streamlined blockchain system. This point is often overlooked in tokenization discussions.

Tokenization as standardised ship containers

Tokens can be likened to standardised shipping containers, accommodating various financial products within fixed dimensions. This approach allows digital money and assets to coexist in one ecosystem, reducing settlement times.

Tokenization simplifies the process of putting assets on-chain, essentially creating virtual boxes to hold asset, customer, or transaction data. It’s not magic, but computer programming logic with legal and regulatory processes still applying.

Lloyds Banking Group effectively conveyed these fundamental concepts. However, the claim that tokenization increases liquidity through fractional ownership is debatable. The question remains: does allowing more people to buy an undesirable asset truly increase its liquidity?

Leave a Reply